Special Feature

13 Nigerian Online & Tech Companies That Were Acquired By Local And Foreign Investors

Nigerian internet-based firms being acquired is a relatively recent trend. This is logical, given that the movement just began a little more than seven years ago.

The increased rate of acquisition of Nigerian online businesses, on the other hand, is worth noting. While many entrepreneurs regard acquisition as the pinnacle of success, it may be a pain in the flesh for a select minority.

In contrast to foreign mergers, Nigerian online startup acquisitions are frequently shrouded in secrecy. We rarely have any idea what processes are involved, let alone how much money they are worth.

Nonetheless, we’ve gathered a list of Nigerian startups and online tech companies that have been bought by both domestic and foreign companies.

Yarnable (acquired by MobiQube and Le Proghrammeen Solutions)

The first acquisition of a Nigerian online company occurred in 2011. This happened when Yarnable was acquired by Abuja-based MobiQube and Le Proghrammeen.

Yarnable was a free micro-discussion service similar to Twitter that allowed users to create and share brief subjects of interest in less than 140 characters. Yarnable’s acquisition by MobiQube and Le Proghrammeen for a meager $3000 could be traced back to finance and technical support issues, according to reports.

Ahmad Mukoshy, the founder of Yarnable

Yarnable’s dismal journey could be summarized as follows: it was founded in 2011, attracted roughly 300 users, was acquired in 2015, and then perished.

Fortunately, Ahmad Mukoshy, the founder of Yarnable, went on to start Gigalayer, a web hosting firm that he has successfully maintained since 2013.

Oya.com.ng (acquired by Wakanow)

Wakanow, a leading travel operator in Nigeria, purchased Oya.com.ng, an online bus ticketing startup, for an initially undisclosed fee in 2014. It took another year to confirm that the deal was for $2.5 million, which was a significant sum by Nigerian startup standards at the time.

The sale, which was worth nearly 50 times what Oya.com.ng was worth two years prior, is still recognized as one of the biggest in Nigerian startup acquisition history.

We may deduce from this that Oya.com.ng was a very profitable startup. As a result, one could wonder what could have motivated the company’s selling. For the time being, all we know is that Oya.com.ng is still operational, but with Wakanow as its parent firm.

It remains to be seen whether this transaction was beneficial or not. However, given the substantial profit margin, it does not appear to be a disadvantage.

Jobberman (acquired by OAM)

On April 30, 2015, Nigeria’s leading job recruiting platform, Jobberman.com, announced that the One Africa Media (OAM) group has purchased a 100 percent ownership in the company.

OAM has established itself as a key player in operating and investing in a portfolio of online marketplaces centered on employment, vehicles, travel, and real estate, with operational bases in various African nations (Kenya, Nigeria, Tanzania, and a few more).

Jobberman was founded by Olalekan Olude, Ayodeji Adewunmi and Opeyemi Awoyemi in 2009.

All three co-founders retained their jobs in the company while becoming shareholders at OAM.

Zinternet (acquired by Konga)

Konga completed its 100 percent acquisition of mobile banking company Zinternet on June 23, 2015. Konga announced the acquisition in a news release, stating that it will help power Konga’s proprietary payment system, KongaPay.

While the transaction was clearly beneficial to Konga, the impact on the acquired company appeared to be ambiguous. All we know is that Zinternet didn’t get as much acclaim in the deal since Konga got all of the attention.

However, given Zinternet has shown no signs of dissatisfaction with the acquisition, it appeared to be a good fit.

Insured.ng (acquired by Click n Compare)

The startup journey of Insured.ng, a Spark-funded insurance deals comparison portal for Nigerians, has been challenging.

Spark terminated future investment in Insured.ng and three other firms in June 2015, deeming them defunct or non-active. Despite this setback, they were able to grow to the point where they were acquired by a South African firm (Click n Compare) a few months later in August 2015.

Insured.ng and Click n Compare both launched in 2013, which is a coincidence.

Due to their investor’s withdrawal, this acquisition was unquestionably a lifesaver for Insured.ng. According to the parties involved, the transaction was to allow Insured.ng capitalize on its current traction and partnerships.

Vanso (acquired by Interswitch)

Interswitch purchased Vanso, a FinTech startup that provides mobile and internet solutions for Nigerian banks, in February 2016. It remains one of, if not the largest, takeover deals in Nigerian internet startup history, valued at N15 billion (in stock and cash).

Prior to the acquisition, Interswitch was rumored to be on the cusp of a $1 billion IPO, a move that would have made it Africa’s first Startup Unicorn. The purchase of Vanso may have been a move in the right direction.

Unfortunately, due to the uncertainty surrounding Nigeria’s decreasing economy, what had reportedly spurred the acquisition of Vanso did not go as planned later in December of the same year.

DealDey (acquired by Ringier Africa Deals Group)

Ringier Africa Deals Group, a joint venture between Switzerland’s Ringier Africa and South Africa’s Silvertree Internet Holdings, bought online shopping platform DealDey on March 23rd, 2016.

DealDey had already proven popular with investors, receiving $5 million from AB Kinnevik in 2015 before spinning off its business promotion and listings component, PromoHub, into its own company and establishing LYF, a socially-driven business listing, review, and transactional platform.

Dealdey did not avoid the specific obstacles experienced by startups, notably in the eCommerce market, prior to the acquisition. As a result, nearly 60% of the company’s workers was laid off.

Despite the undeniable expansion of the Nigerian IT landscape, this acquisition turned out to be a big boost to the ecosystem.

Easyappetite (acquired by Metro Africa Express (MAX))

In September 2016, the hyper-local food delivery firm Easyappetite (founded in 2012) was bought by the last-mile delivery startup Metro Africa Express (MAX).

The acquisition, which coincided with plans to launch a bespoke food delivery arm called MAX Eats, appears to have gone well, as Easyappetite Co-founder/CEO Deji Opoola joined the MAX team to head up the marketing department.

This purchase is noteworthy since it appears to be more of a collaboration, and operations are now going nicely.

TopCheck (acquired by PriceCheck)

Silvertree Internet Holdings, the parent firm of South African firm, PriceCheck, purchased online insurance comparison startup TopCheck in February 2017.

TopCheck is a free online comparison service for insurance goods, loans, and broadband internet services for Nigerians, which was launched with considerable enthusiasm in 2015.

According to TopCheck’s creator (Thomas Pilar), the combination of the two companies will propel TopCheck to new heights throughout Africa.

The acquisition of TopCheck appears to be going well. It’s worth noting that the founders, who are of German heritage, traveled to Nigeria in search of tremendous chances. They were able to raise a €1 million financing round a few months prior to the acquisition.

Konga (acquired by Zinox Group)

In February 2018, Zinox Group acquired Konga, one of Nigeria’s biggest eCommerce giants in a sudden swoop.

Zinox Group concluded the acquisition of Konga after months of negotiations with major investors, including Naspers and AB Kinnevik in a landmark deal.

The Leo Stan Ekeh-owned Zinox Group is a technology company that built Nigeria’s first internationally certified computer systems and has large substantial stakes in ICT in Nigeria.

Konga is likely one of the few eCommerce platforms in Africa with its own bespoke software solutions. In February 2014, Konga started work on its own custom marketplace platform, SellerHQ and by September of that, the year it was ready and working better than 3rd party solutions.

Paystack (Acquired by Stripe)

Stripe, the American fintech giant, purchased Paystack in October 2020, two years after making a strategic investment in the firm.

Stripe is estimated to have invested around $200 million for the acquisition, though the financial details aren’t public.

It will be the largest acquisition deal ever made in Nigeria. It beats out Visa’s $200 million purchase of 20% of Interswitch in November 2019.

Paystack was founded in January 2016 and was the first Nigerian startup to be admitted into the world-renowned Y Combinator program in Silicon Valley, where it received $120,000 in seed capital.

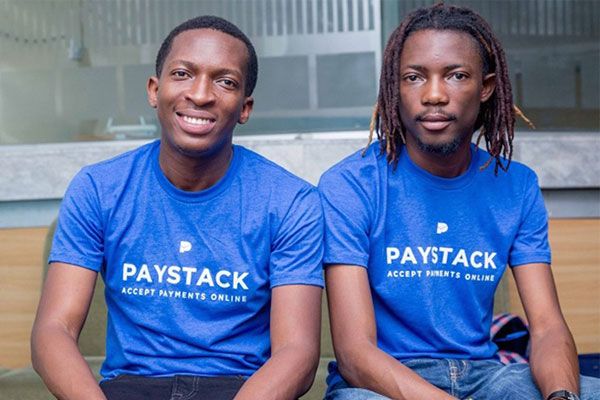

The duo of Shola Akinlade and Ezra Olubi founded Paystack.

Paystack founders: Shola Akinlade and Ezra Olubi.

It is also one of several fintechs that have disrupted the Nigerian fintech space. It develops APIs for identification verification, account balance checks, and automated bank transfers, among other things. As a result of all of this, it has lowered the cost of processing payments in Nigeria, along with other fintech businesses like Flutterwave.

Small enterprises, larger corporations, fintechs, educational institutions, and online betting organizations are among Paystack’s 60,000 customers.

Tingo (acquired by Iweb Inc)

.

.

Iweb Inc. announced in August 2021 that it has finalized the 100% acquisition of Tingo Mobile, PLC.

Tingo is Nigeria’s leading technology and Device as a Service platform aimed at accelerating digital commerce, especially in Agri-Tech & Fin-Tech verticals in Nigeria.

Tingo has more than 9 million subscribers and has supplied almost 30 million mobile devices since 2014.

Iweb Inc. afterwards applied to Finra to have its name changed and a new trade symbol assigned to reflect Tingo Mobile Plc’s new business emphasis.

Dozy Mmobuosi, co-founder Tingo

Mr. Dozy Mmobuosi is the Group Chief Executive Officer of Tingo Mobile PLC (Nigeria), which he co-founded in 2001.

Tingo which is regarded as of one of the most valuable fintech firms to ever come from Africa, was acquired by iWeb for $3.7 billion.

Mainone (acquired by Equinix)

Equinix, an America’s digital infrastructure firm, completed the acquisition of MainOne, a West African data center and connectivity solutions provider, on December 7, 2021.

MainOne, founded by Funke Opeke, was acquired by Equinix after a series of expansions.

Equinix, which is presently valued at $73 billion, paid $320 million (N131.8 billion) for Mainone .

Ms. Opeke and the company’s management team will continue to serve in their current roles after the acquisition is completed.

Funke Opeke, Mainone Founder

Ms. Opeke founded MainOne in 2010. This was after returning to Nigeria from the United States and observing the terrible internet connectivity available to Nigerians.

MainOne was one of the first privately operated, open-access undersea high-capacity cable submarines in West Africa.

It’s a 7,000-kilometer cable that connects Portugal with West Africa, with stops in Ghana, Senegal, Ivory Coast, and Lagos. MainOne also operates a 1,200-kilometer terrestrial fibre network in Lagos, Edo, and Ogun in southern Nigeria.