Governance and Developments

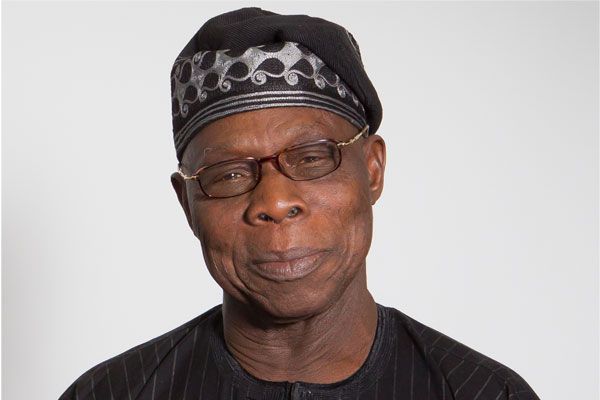

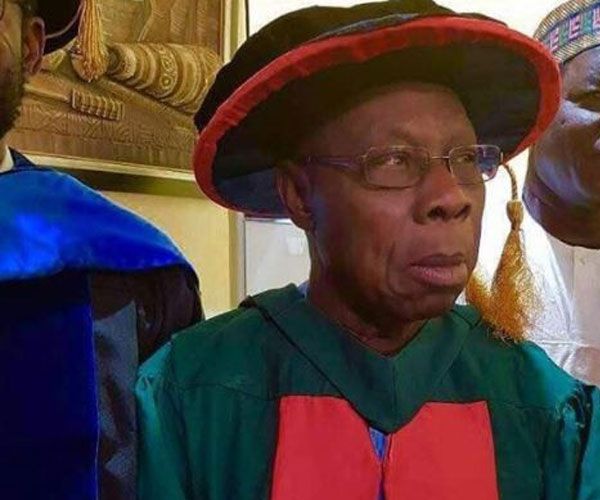

4 Policies By Obasanjo’s Government That Transformed Nigeria’s Economy

The GSM Revolution: “Hello, Can You Hear Me?”

In 2001, Nigeria went from “the line is not connecting” to “I’ll call you back” overnight. The introduction of GSM mobile networks shattered NITEL’s monopoly and opened the doors for private telecom companies. Then came MTN, Econet (later Airtel), Glo, Etisalat (later 9Mobile). Almost immediately, Nigeria transformed into one of the fastest-growing telecom markets in Africa. The effects were massive. Jobs sprang up like mushrooms after a rainy day – from engineers laying cables to street vendors selling recharge cards and phone cases. SMEs suddenly had real-time communication with customers and suppliers, which meant more deals, more growth, and fewer “sorry, my letter didn’t arrive” excuses. And the money? Oh, it rolled in. By 2011, the telecom boom was a key driver of GDP growth, adding around 9%. On top of that, mobile banking and fintech started taking root, giving people in rural areas access to financial services they’d never had before.The Car Import Ban: Bye-bye to Jalopies

Before 2002, Nigeria’s roads were filled with European hand-me-downs – cars that had clearly lived three lives before arriving here. Then Obasanjo’s government banned imports of cars older than eight years. Sure, people grumbled about affordability at first, but car companies quickly got creative. Installment payment plans became the norm, and suddenly middle-class Nigerians could dream of owning a brand-new car without selling half their land. Corporate fleet programs flourished, banks dove into auto financing, and the country’s vehicle stock started looking a little shinier. Road safety improved (somewhat), and the auto-finance market got a nice boost. You could almost feel the pride when folks drove home in a brand-new Corolla instead of “managing” a smoky old Peugeot 504.The Paris Club Debt Deal: The $30 Billion Debt Forgiveness

In 2005, Obasanjo pulled off one of Nigeria’s greatest economic magic tricks. He convinced the Paris Club of creditors to cancel $18 billion of our debt in exchange for a $12 billion repayment. Just like that, $30 billion in debt vanished from our books.-

READ ALSO: Things You May Not Know About Olusegun Obasanjo’s Step Son, Tunde Baiyewu, Of Lighthouse Family

Banking Consolidation: From Many Small Fish to Big Sharks

In 2004, under Central Bank Governor Charles Soludo, the minimum capital requirement for banks jumped from ₦2 billion to ₦25 billion. It was a “merge or die” moment. Dozens of smaller banks either joined forces or got swallowed by bigger ones. The result? A leaner, meaner, and more resilient banking sector that could finance large-scale projects in oil, gas, telecoms, and infrastructure. Public confidence rose, credit flowed more freely, and Nigeria’s financial system finally had the muscle to support a growing economy.

The Final Analysis

Obasanjo’s economic reforms were like a home renovation, you might not love every design choice, but the house ended up much sturdier than before. GSM connected millions, the car import ban modernized the roads, the Paris Club deal freed us from crippling debt, and banking consolidation made our financial sector fit for the big leagues. By the time he left office in 2007, Nigeria’s economy was no longer that broken-down danfo. It was more like a freshly serviced Toyota Hilux, still facing potholes ahead, but with a much better chance of getting to the destination.-

READ ALSO: How the Paris Club Wrote Off Nigeria’s Debt, and How We Found Ourselves Back in Huge Debt

Discover more from Jojo Naija

Subscribe to get the latest posts sent to your email.

Continue Reading