Throwback/Historical

How the Paris Club Wrote Off Nigeria’s Debt, and How We Found Ourselves Back in Huge Debt

This is a story of how the Paris Club wrote off Nigeria’s debt. The Paris Club is a group of rich creditor countries that acted as the neighbourhood’s unofficial lenders.

Once upon a time, Nigeria found itself swimming in debt. The debt? A whopping $30 billion that Nigeria owed to the Paris Club.

This was in the early 2000s, and the weight of this debt was pushing the country down with almost no hope of standing straight. Now, if you’ve ever been in debt, you know it’s no easy life.

The Paris Club was constantly demanding their money back, and we had barely enough to feed ourselves, let alone paying off these massive loans.

But then, in came a miracle. The saviour steps in: Dr. Ngozi Okonjo-Iweala.

Enters Dr. Ngozi Okonjo-Iweala, our economic heroine in Ankara. Back then, she was Nigeria’s Minister of Finance, and she came to the table ready to fight like a mama bear defending her cubs.

Her mission? To get the Paris Club to understand Nigeria’s predicament and forgive part, if not all, of the debt. Dr. Ngozi, with her Harvard and MIT degrees, had the brains and guts for the job.

In 2005, she spearheaded negotiations with the Paris Club, which involved some serious back-and-forth.

It was like going to Alaba Market, but instead of haggling for electronics, she was bargaining for our country’s financial future.

Enters Dr. Ngozi Okonjo-Iweala, our economic heroine in Ankara. Back then, she was Nigeria’s Minister of Finance, and she came to the table ready to fight like a mama bear defending her cubs.

Her mission? To get the Paris Club to understand Nigeria’s predicament and forgive part, if not all, of the debt. Dr. Ngozi, with her Harvard and MIT degrees, had the brains and guts for the job.

In 2005, she spearheaded negotiations with the Paris Club, which involved some serious back-and-forth.

It was like going to Alaba Market, but instead of haggling for electronics, she was bargaining for our country’s financial future.

Dr. Okonjo-Iweala wasn’t alone. President Olusegun Obasanjo was also front and center, traveling across continents to plead Nigeria’s case. He showed up like a statesman, using both diplomacy and, no doubt, some charm to get the Paris Club members to see why a debt write-off was the only way forward.

Dr. Okonjo-Iweala wasn’t alone. President Olusegun Obasanjo was also front and center, traveling across continents to plead Nigeria’s case. He showed up like a statesman, using both diplomacy and, no doubt, some charm to get the Paris Club members to see why a debt write-off was the only way forward.

The Return to Debt: What Went Wrong?

Fast-forward to today, and Nigeria is back to a heavily indebted status. As of now, we owe tens of billions of dollars again. As of Q1 2024, Nigeria’s foreign debt stood at approximately $42.12 billion (N56.02 trillion).

What happened? Well, it’s a long story, but simply put: we got comfortable. Oil prices fell, revenue dropped, and, to make up for it, the government began borrowing again. Corruption, as usual, added fuel to the fire.

The Return to Debt: What Went Wrong?

Fast-forward to today, and Nigeria is back to a heavily indebted status. As of now, we owe tens of billions of dollars again. As of Q1 2024, Nigeria’s foreign debt stood at approximately $42.12 billion (N56.02 trillion).

What happened? Well, it’s a long story, but simply put: we got comfortable. Oil prices fell, revenue dropped, and, to make up for it, the government began borrowing again. Corruption, as usual, added fuel to the fire.

Instead of managing our resources prudently, we found ourselves borrowing to fund projects without enough accountability. Loans were taken for all sorts of reasons, some even questionable, and in no time, the debt figures started to rise like garri in hot water.

And just like that, the Paris Club’s lesson was forgotten. We went back to old habits, accumulating debt without much worry about the long-term effects.

Instead of managing our resources prudently, we found ourselves borrowing to fund projects without enough accountability. Loans were taken for all sorts of reasons, some even questionable, and in no time, the debt figures started to rise like garri in hot water.

And just like that, the Paris Club’s lesson was forgotten. We went back to old habits, accumulating debt without much worry about the long-term effects.

Ngozi Okonjo-Iweala

Enters Dr. Ngozi Okonjo-Iweala, our economic heroine in Ankara. Back then, she was Nigeria’s Minister of Finance, and she came to the table ready to fight like a mama bear defending her cubs.

Her mission? To get the Paris Club to understand Nigeria’s predicament and forgive part, if not all, of the debt. Dr. Ngozi, with her Harvard and MIT degrees, had the brains and guts for the job.

In 2005, she spearheaded negotiations with the Paris Club, which involved some serious back-and-forth.

It was like going to Alaba Market, but instead of haggling for electronics, she was bargaining for our country’s financial future.

Enters Dr. Ngozi Okonjo-Iweala, our economic heroine in Ankara. Back then, she was Nigeria’s Minister of Finance, and she came to the table ready to fight like a mama bear defending her cubs.

Her mission? To get the Paris Club to understand Nigeria’s predicament and forgive part, if not all, of the debt. Dr. Ngozi, with her Harvard and MIT degrees, had the brains and guts for the job.

In 2005, she spearheaded negotiations with the Paris Club, which involved some serious back-and-forth.

It was like going to Alaba Market, but instead of haggling for electronics, she was bargaining for our country’s financial future.

Olusegun Obasanjo

Dr. Okonjo-Iweala wasn’t alone. President Olusegun Obasanjo was also front and center, traveling across continents to plead Nigeria’s case. He showed up like a statesman, using both diplomacy and, no doubt, some charm to get the Paris Club members to see why a debt write-off was the only way forward.

Dr. Okonjo-Iweala wasn’t alone. President Olusegun Obasanjo was also front and center, traveling across continents to plead Nigeria’s case. He showed up like a statesman, using both diplomacy and, no doubt, some charm to get the Paris Club members to see why a debt write-off was the only way forward.

The Conditions for Debt Relief

The Paris Club didn’t just forgive Nigeria out of the goodness of their hearts. No, they had conditions. For starters, Nigeria had to pay back a significant portion of the debt, which meant making sacrifices. Plus, they wanted assurances that Nigeria would manage her finances better in the future—no more reckless borrowing. Nigeria was also expected to implement reforms to strengthen her economy and reduce corruption. Essentially, the Paris Club wanted us to stop “eating rice with two hands,” and learn some fiscal discipline. In October 2005, after months of negotiation, the Paris Club finally agreed to cut Nigeria some slack. But this wasn’t free money. Nigeria had to pay back $12.4 billion of the debt first. In December 2005 to March 2006 – over these months, Nigeria scraped together the funds and paid the agreed sum. And just like that, Nigeria’s remaining debt of around $18 billion was written off. This was the largest debt relief deal in Africa’s history!Debt-Free for a Moment…But Not For Long

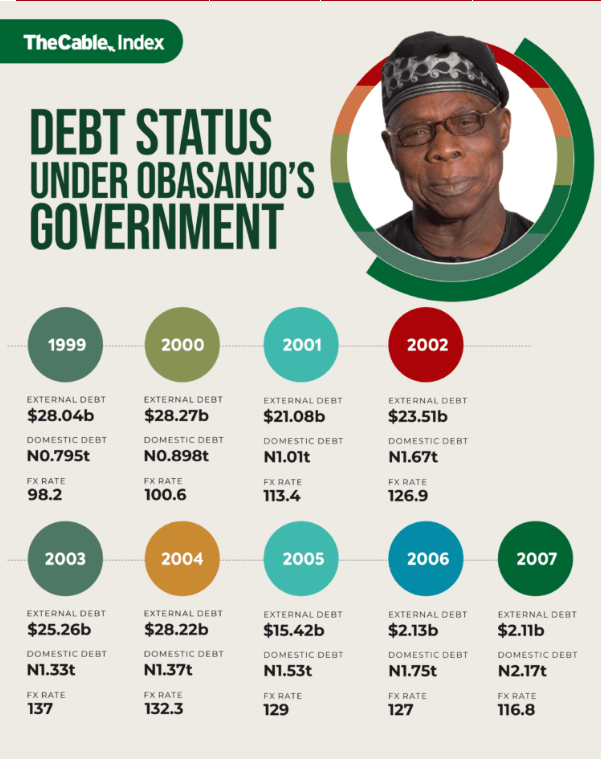

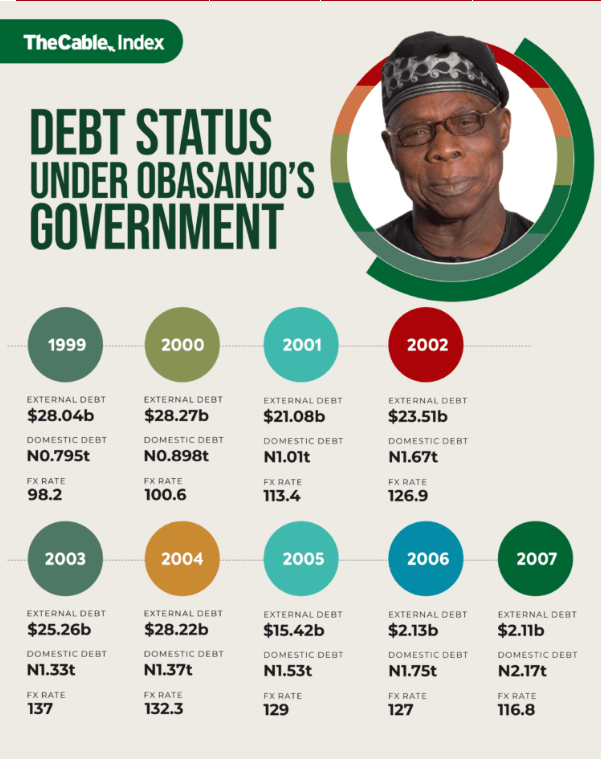

By 2006, Nigeria was free from the burden of the Paris Club debt. We were debt-free, and for once, it felt like we could dream again. The relief sparked optimism, and there was hope that the country could use its oil wealth to build infrastructure, create jobs, and improve healthcare and education. But ah! “Shine your eye” was not part of our plan.

Credit: The Cable

Instead of managing our resources prudently, we found ourselves borrowing to fund projects without enough accountability. Loans were taken for all sorts of reasons, some even questionable, and in no time, the debt figures started to rise like garri in hot water.

And just like that, the Paris Club’s lesson was forgotten. We went back to old habits, accumulating debt without much worry about the long-term effects.

Instead of managing our resources prudently, we found ourselves borrowing to fund projects without enough accountability. Loans were taken for all sorts of reasons, some even questionable, and in no time, the debt figures started to rise like garri in hot water.

And just like that, the Paris Club’s lesson was forgotten. We went back to old habits, accumulating debt without much worry about the long-term effects.

Lessons for the Future

There’s a saying that goes, “Once bitten, twice shy.” Nigeria, however, seems to be like the “goat that grazes near the lion’s den.” We keep finding ourselves back in debt, even after that historic write-off. Our leaders need to learn that loans should be taken responsibly, for projects that genuinely benefit the people. As citizens, we should keep an eye on our government’s spending and hold them accountable. Debt isn’t inherently bad, but if we keep borrowing without long-term plans, we’ll be telling the same story again and again, each time a little sadder than before. Conclusion Nigeria’s journey from debt, through debt relief, and back into debt, is a tale as old as time. It’s a story of resilience, missteps, and the hope that, someday, we’ll finally break the cycle and stand debt-free for good. Until then, let’s remember that managing our finances, both as individuals and as a country, is the real key to staying afloat. And maybe, just maybe, we’ll avoid having to return to the Paris Club for another lifeline. # Paris Club Wrote Off Nigeria’s Debt # Paris Club Wrote Off Nigeria’s DebtDiscover more from Jojo Naija

Subscribe to get the latest posts sent to your email.

Continue Reading